“ILOE” or “Involuntary Loss of Employment Insurance”, a scheme that is mandated by the UAE government and offers employees insurance if they involuntarily lose their jobs through no fault of their own, including termination of contracts that are not by way of resignation or termination due to breach of disciplinary actions.

Under this system, employees who fulfill these conditions and having active subscriptions, stand to benefit from financial compensation on a month-to-month basis when they lose their job owing to reasons not within their control. This is not their original pay but a certain percentage of just their basic pay.

Let’s get more details about the ILOE in this blog including its categories, and UAE platforms.

What is ILOE Insurance UAE?

According to the Federal Decree Law no. 13/2022 that came into effect as of January 1st, 2023. The scheme of ILOE is provided by Dubai Insurance and is overseen by the UAE Ministry of Human Resources and Emiratization. The purpose and objectives of the scheme are to protect employees who involuntarily lose their jobs and offer them some temporary security until they can secure alternative jobs.

Key Features of ILOE Insurance UAE

The essential features of the ILOE Insurance plan are as follows:

Mandatory Subscription

Subscription to ILOE Insurance is a mandatory requirement for all employees within both the federal and private sectors of the UAE workforce.

The rationale for the mandatory requirement is essentially based on covering the workforce under one umbrella.

Financial Compensation

In cases where a subscriber involuntarily loses a job, they become eligible to claim financial compensation.

This measure offers compensation, which corresponds to 60 percent of the average basic salary for a certain period of time before the loss of a job. The amount of financial compensation is offered monthly.

Duration of Benefits

Concerning any one claim, an eligible person would be entitled to compensation for up to three consecutive months.

Salary Categories

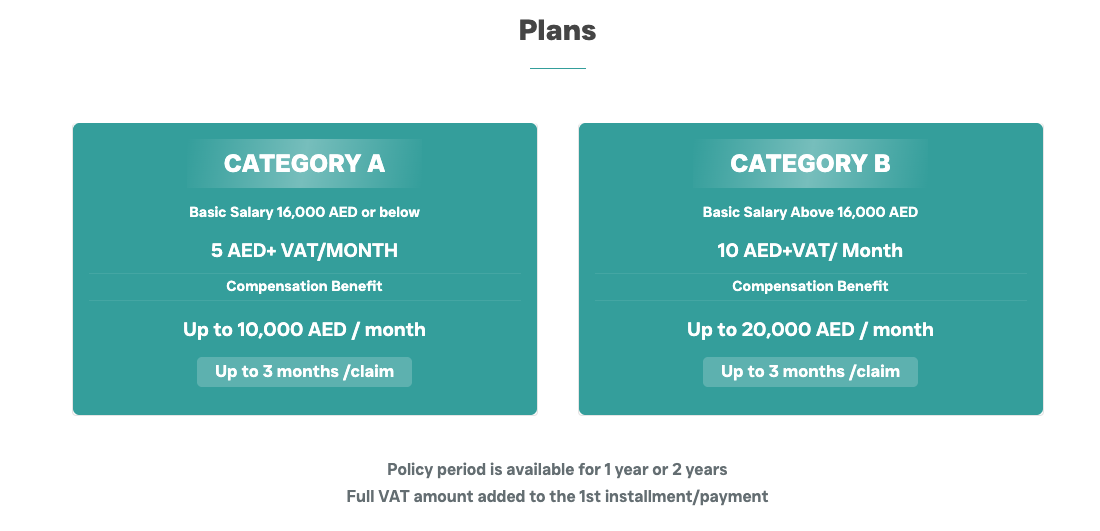

The insurance premiums paid and the compensation are categorized into two types depending on the employee’s income of the employee.

Eligibility Period

To be qualified to submit their claims, it is essential to note that the individuals wanting to benefit from the insurance policy will need to have been actively involved in the program by paying their subscription contributions at least once every month for the past 12 months before their unemployment.

Exclusions

Certain categories of workers need not subscribe to ILOE and will not benefit from it. These categories of workers include business owners and investors, home helpers, temporary workers, contract workers, workers below 18 years of age, pensioners who apply for jobs, free zone and exempt employees as specified, and free zone workers who have worked for a short period.

Benefits of ILOE Insurance

The ILOE Insurance plan has various benefits, which are aimed at improving the welfare of the employees.

Financial Security During Unemployment

The most significant advantage of ILOE lies in the financial assistance it offers to workers who lose their jobs unexpectedly. It reduces their shortage of funds and makes them less desperate for inappropriate jobs for their immediate payroll benefits.

Compliance with Labour Law

As employees are enrolled in ILOE, it is ensured that labour policy requirements of the UAE are adhered to in this context. Failure to do so attracts penalties, as well as issues in renewing employee work visas and labour cards. Notably, adherence is beneficial to employees and employers in this context.

Talent Attraction

From a policy-oriented point of view, the program helps to make the UAE an even more attractive destination for the best global talent. The job seekers may feel more secure in their job acceptance in the UAE, knowing they will have a safety net in case.

ILOE Dubai Insurance Cost

The cost of ILOE insurance in Dubai and other places within the UAE is based on different classes of basic salaries.

Category A

For those whose basic salary is AED 16,000 or less, the monthly premium amounts to AED 5 plus the relevant amount of VAT.

The maximum possible monthly compensation payment, as per this kind of benefit, ranges from AED 10,000 on a valid claim.

Category B

For employees whose basic salary is above AED 16,000, the monthly amount is AED 10 + VAT.

In the said category of claims, the maximum amount of compensation paid per month is up to AED 20,000.

Premiums may be paid on different schedules, which may be on a monthly, quarterly, semi-annual, annual, or on a longer-term basis than a year, say two years, as may be applicable and available in the market during subscription. These may be arranged in such a way as to provide convenience to the subscribers.

ILOE UAE Platforms

Through official platforms, employees can subscribe, renew, and make claims under the ILOE scheme. Some of these platforms include:

Official ILOE Portal

The major online platform through which ILOE services are obtained is the official ILOE portal www.iloe.ae

On this platform, individuals can, among other things, register, renew their insurance policies, retrieve information about insurance policies, download insurance certificates, make claims, and even pay subscription premium charges free of any additional service charges.

ILOE Mobile App

The ILOE mobile application also facilitates easy access to policy information, premium payments, renewal, and claims. Additionally, the application allows users to log in with their details or UAE Pass to easily manage their accounts.

MOHRE e-Services

The Ministry of Human Resources and Emiratisation’s e-services section has a facility for Quick Pay of ILOE premium and status, allowing citizens a different means of subscription.

Alternative Channels with Service Charges

They may also subscribe or pay premiums via other service centres that are authorised, including exchange houses such as Al Ansari Exchange, business centres like Tawjeeh, Tasheel, bank apps, or ATMs, telecom service providers, or kiosks, among others, who may impose service costs on top of the premium.

ILOE Insurance Check and Fine Check

Maintaining awareness of your ILOE insurance status and any outstanding fines is important for compliance and eligibility.

Checking Policy Status

You can check your current ILOE insurance policy status on the official ILOE portal by logging in using your Emirates ID with an OTP, UAE Pass, or other supported credentials. The dashboard will display details such as policy start and expiry dates, payment history, coverage category, and the most recent premium payment status.

The ILOE mobile app provides a similar interface to view policy details, payment information, and renewal dates.

If you subscribed through alternative channels such as a bank or exchange house, you may also be able to check your status through those services.

Fine Checks

If you failed to subscribe on time or missed premium payments for a defined period, you may incur fines. Common fine categories include a fine for not subscribing to ILOE when required and fines for not paying premiums within a specified number of days after due dates. You can check fines and pay them via the MOHRE website, the MOHRE mobile app, or through the ILOE portal’s Quick Pay function.

Consequences of Non-Compliance

Failure to subscribe or maintain active premium payments can result in fines as well as potential complications with visa renewal, labour card processing, or administrative procedures. Prompt resolution of fines and compliance with subscription rules helps avoid these issues.

Summary of ILOE Insurance in Dubai and the UAE

In total, ILOE Insurance in the United Arab Emirates is a mandatory unemployment protection scheme for most employees that provides temporary financial support if they lose their job involuntarily. The scheme’s core features include a simple premium structure, reasonable compensation benefits, a clear eligibility framework, and convenient platforms for subscription and management. It requires continuous subscription payments to be eligible for claims and includes compliance mechanisms to ensure widespread participation. By offering financial protection during unemployment, ILOE aims to enhance employee welfare and support the labour market in the UAE.

If you need more specific guidance on how to check your own ILOE policy status step by step or how to file a claim through the portal or app, I can provide a detailed walkthrough.

Conclusion

For clients looking at setting up a business in the UAE, relocation, or administration of employment and visa compliance, DXB VIP offer business setup solutions in the UAE. DXB VIP understands the nuances of ILOE insurance, our professional business consultants advise the employers and employees to subscribe to the insurance on time to avoid fines.

By means of more general services regarding company formation, UAE residency, Golden Visa processing, corporate banking assistance, and compliance support, DXB VIP is your business solutions in the UAE.